A lack of knowledge in structuring an investment portfolio when nearing retirement is a challenge many individuals face, especially when sufficient income needs to be generated to provide for expenses, whilst taking as little risk as possible.

This pre-retirement/retirement phase focuses on capital preservation instead of growth, but yield is still important for needs to be met.

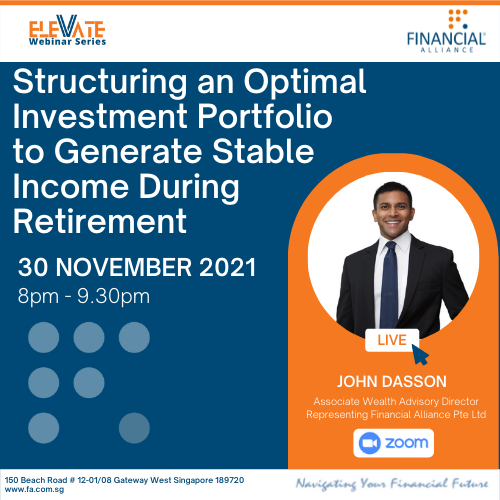

In this webinar, John will go through a case study, detailing how an optimal portfolio can be structured to meet an individual’s tailored needs in retirement. Webinar attendees will gain an insight into the process and be equipped to make better decisions regarding their own investment portfolios.

Register for our webinar today!